Climate change is intensifying, causing droughts, floods, and other extreme events that harm lives and livelihoods, particularly in countries least responsible for global emissions. Yet, the resources to address the crisis remain inadequate. This factsheet, part of the IEJ’s 2025 G20 series, examines what climate finance is, why it matters, the role of the G20, and the risks in current approaches that can worsen inequality and debt.

What is climate finance?

Climate finance refers to the funding needed to mitigate the causes of climate change, adapt to its impacts, and address loss and damage caused by climate-related disasters. This funding can take the form of grants, loans, guarantees, green bonds, debt swaps, equity investments, carbon taxes, and carbon credit trading.

Developing countries require between $5 trillion and $6.9 trillion by 2030 to implement their national climate plans, yet existing commitments have fallen far short. In 2010, developed countries pledged $100 billion annually to support climate action in vulnerable countries by 2020 but failed to meet the target. In 2024, this pledge was increased to $300 billion, but significant gaps remain.

The debt trap in climate finance

Much of current climate finance comes in the form of loans rather than grants. This increases debt burdens in developing countries already struggling with high repayment costs. South Africa’s Just Energy Transition Plan, for example, is 96% loan-based and heavily dependent on private investment, which prioritises profit over equity. As a result, countries are forced to choose between servicing debt, investing in development, and taking climate action.

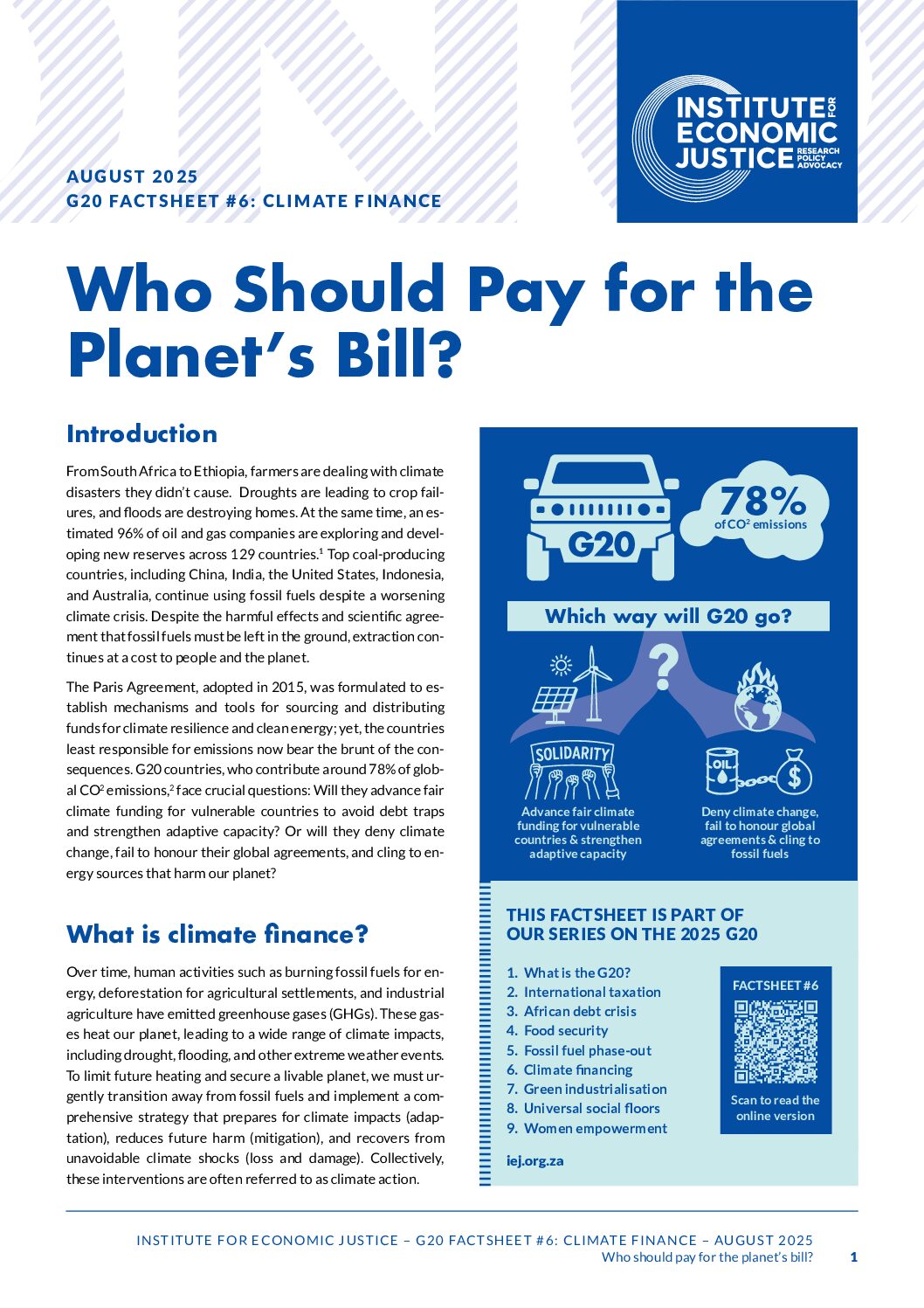

The G20’s role

The G20, responsible for around 78% of global CO2 emissions, has positioned itself as a leader in climate finance discussions. It has promoted tools such as blended finance, public-private partnerships, and the involvement of multilateral development banks to mobilise private capital. However, these approaches often shift risks onto the public while protecting private investors, locking countries into costly long term contracts and increasing debt vulnerability.

What is on the G20 agenda now?

South Africa has raised the issue of how developing countries can access climate finance without taking on more debt. Current discussions focus on mobilising larger-scale financing, increasing grants and concessional loans, lowering capital costs for developing countries, and expanding funding for renewable energy transitions. However, more scrutiny is needed of the G20’s reliance on de-risking strategies that privilege private profit over public welfare.

A call for fair climate finance

The IEJ advocates for climate finance that:

- Prioritises grants over loans to avoid deepening debt.

- Reflects the “polluter pays” principle and common but differentiated responsibilities.

- Ensures transparency in agreements and public oversight of funds.

- Strengthens community involvement and accountability in climate action.

Learn more

Explore the full findings and recommendations in the IEJ’s G20 Climate Finance Factsheet.

Other factsheets in the 2025 G20 series include:

Amaarah is a Junior Programme Officer in the Rethinking Economics for Africa project. She is currently studying towards her Masters in Applied Development Economics at Wits University.

Amaarah is a Junior Programme Officer in the Rethinking Economics for Africa project. She is currently studying towards her Masters in Applied Development Economics at Wits University.  Dr James Musonda is the Senior Researcher on the Just Energy Transition at the IEJ. He is also the Principal Investigator for the Just Energy Transition: Localisation, Decent Work, SMMEs, and Sustainable Livelihoods project, covering South Africa, Ghana, and Kenya.

Dr James Musonda is the Senior Researcher on the Just Energy Transition at the IEJ. He is also the Principal Investigator for the Just Energy Transition: Localisation, Decent Work, SMMEs, and Sustainable Livelihoods project, covering South Africa, Ghana, and Kenya. Dr Basani Baloyi is a Co-Programme Director at the IEJ. She is a feminist, development economist and activist. She gained her research experience while working on industrial policy issues in academia, at the Centre For Competition, Regulation and Economic Development (CCRED) and Corporate Strategy and Industrial Development (CSID) Unit.

Dr Basani Baloyi is a Co-Programme Director at the IEJ. She is a feminist, development economist and activist. She gained her research experience while working on industrial policy issues in academia, at the Centre For Competition, Regulation and Economic Development (CCRED) and Corporate Strategy and Industrial Development (CSID) Unit. Dr Andrew Bennie is Senior Researcher in Climate Policy and Food Systems at the IEJ. He has extensive background in academic and civil society research, organising, and activism. Andrew has an MA in Development and Environmental Sociology, and a PhD in Sociology on food politics, the agrarian question, and collective action in South Africa, both from the University of the Witwatersrand.

Dr Andrew Bennie is Senior Researcher in Climate Policy and Food Systems at the IEJ. He has extensive background in academic and civil society research, organising, and activism. Andrew has an MA in Development and Environmental Sociology, and a PhD in Sociology on food politics, the agrarian question, and collective action in South Africa, both from the University of the Witwatersrand. Juhi holds a Bachelor of Arts degree in International Relations and Sociology from Wits University and an Honours degree in Development Studies from the University of Cape Town. Her current research focus is on social care regimes in the South African context, with a particular focus on state responses to Early Childhood Development and Long-Term Care for older persons during the COVID-19 pandemic. Her other research areas include feminist economics, worlds of work and the care economy.

Juhi holds a Bachelor of Arts degree in International Relations and Sociology from Wits University and an Honours degree in Development Studies from the University of Cape Town. Her current research focus is on social care regimes in the South African context, with a particular focus on state responses to Early Childhood Development and Long-Term Care for older persons during the COVID-19 pandemic. Her other research areas include feminist economics, worlds of work and the care economy. Bandile Ngidi is the Programme Officer for Rethinking Economics for Africa. Bandile has previously worked at the National Minimum Wage Research Initiative and Oxfam South Africa. He holds a Masters in Development Theory and Policy from Wits University. He joined the IEJ in August 2018. Bandile is currently working on incubating the Rethinking Economics for Africa movement (working with students, academics and broader civil society).

Bandile Ngidi is the Programme Officer for Rethinking Economics for Africa. Bandile has previously worked at the National Minimum Wage Research Initiative and Oxfam South Africa. He holds a Masters in Development Theory and Policy from Wits University. He joined the IEJ in August 2018. Bandile is currently working on incubating the Rethinking Economics for Africa movement (working with students, academics and broader civil society).  Liso Mdutyana has a BCom in Philosophy and Economics, an Honours in Applied Development Economics, and a Masters in Applied Development Economics from Wits University. His areas of interest include political economy, labour markets, technology and work, and industrial policy. Through his work Liso aims to show the possibility and necessity of economic development that prioritises human wellbeing for everyone.

Liso Mdutyana has a BCom in Philosophy and Economics, an Honours in Applied Development Economics, and a Masters in Applied Development Economics from Wits University. His areas of interest include political economy, labour markets, technology and work, and industrial policy. Through his work Liso aims to show the possibility and necessity of economic development that prioritises human wellbeing for everyone. Joan Stott holds a Bachelor of Business Science in Economics and a Master’s in Economics from Rhodes University. She brings to the IEJ a wealth of experience in public finance management, policy development, institutional capacity-building, and advancing socioeconomic and fiscal justice.

Joan Stott holds a Bachelor of Business Science in Economics and a Master’s in Economics from Rhodes University. She brings to the IEJ a wealth of experience in public finance management, policy development, institutional capacity-building, and advancing socioeconomic and fiscal justice. Siyanda Baduza is a Junior Basic Income Researcher at IEJ. He holds a BSc in Economics and Mathematics, an Honours degree in Applied Development Economics, and is currently completing a Master’s degree in Applied Development Economics at the University of the Witwatersrand. Siyanda’s research focuses on the impacts of social grants on wellbeing, with a particular focus on the gendered dynamics of this impact. His interests include applied micro-economics, policy impact evaluation, labour markets, gender economics, and political economy. He is passionate about translating economic research into impactful policy.

Siyanda Baduza is a Junior Basic Income Researcher at IEJ. He holds a BSc in Economics and Mathematics, an Honours degree in Applied Development Economics, and is currently completing a Master’s degree in Applied Development Economics at the University of the Witwatersrand. Siyanda’s research focuses on the impacts of social grants on wellbeing, with a particular focus on the gendered dynamics of this impact. His interests include applied micro-economics, policy impact evaluation, labour markets, gender economics, and political economy. He is passionate about translating economic research into impactful policy. Shikwane is a Junior Programme Officer at IEJ focusing on civil society support and global governance in the G20. He has a background in legal compliance, IT contracting and student activism. He holds degrees in Political Studies and International Relations, as well as an LLB, from the University of the Witwatersrand.

Shikwane is a Junior Programme Officer at IEJ focusing on civil society support and global governance in the G20. He has a background in legal compliance, IT contracting and student activism. He holds degrees in Political Studies and International Relations, as well as an LLB, from the University of the Witwatersrand. Dr Tsega is a Senior Researcher focusing on Women’s Economic Empowerment within the G20. She examines gender equity in economic policy, with expertise in food systems and small enterprise development. She holds a PhD in development studies from the University of the Western Cape, an MA in Development Economics, and degrees in Development Studies and Economics from UNISA and Addis Ababa University.

Dr Tsega is a Senior Researcher focusing on Women’s Economic Empowerment within the G20. She examines gender equity in economic policy, with expertise in food systems and small enterprise development. She holds a PhD in development studies from the University of the Western Cape, an MA in Development Economics, and degrees in Development Studies and Economics from UNISA and Addis Ababa University. Nerissa is a G20 Junior Researcher at IEJ, focusing on advancing civil society priorities within the G20 framework. She bridges data, research, and policy to advance inclusive economic frameworks. She is completing a Master’s in Data Science (e-Science) at the University of the Witwatersrand, and holds Honours and Bachelor’s Degrees in International Relations with distinction. She has worked as a Research Fellow at SAIIA and a Visiting Research Fellow at Ipea in Brazil.

Nerissa is a G20 Junior Researcher at IEJ, focusing on advancing civil society priorities within the G20 framework. She bridges data, research, and policy to advance inclusive economic frameworks. She is completing a Master’s in Data Science (e-Science) at the University of the Witwatersrand, and holds Honours and Bachelor’s Degrees in International Relations with distinction. She has worked as a Research Fellow at SAIIA and a Visiting Research Fellow at Ipea in Brazil. Dr Mzwanele is a Senior Researcher supporting South Africa’s G20 Sherpa with policy research. He holds a PhD in Economics from the University of Birmingham and an MSc from the University of the Witwatersrand. His work covers open macroeconomics, trade, finance, and higher education policy, and he has published widely on inequality, unemployment, household debt and higher education curriculum reform.

Dr Mzwanele is a Senior Researcher supporting South Africa’s G20 Sherpa with policy research. He holds a PhD in Economics from the University of Birmingham and an MSc from the University of the Witwatersrand. His work covers open macroeconomics, trade, finance, and higher education policy, and he has published widely on inequality, unemployment, household debt and higher education curriculum reform. Kamal is the Project Lead for IEJ’s G20 work, focusing on sovereign debt and development finance. He holds a BComm (Hons) in Applied Development Economics from the University of the Witwatersrand and an Erasmus Mundus Joint Masters in Economic Policies for the Global Transition. He has worked with SCIS, UNCTAD and co-founded Rethinking Economics for Africa.

Kamal is the Project Lead for IEJ’s G20 work, focusing on sovereign debt and development finance. He holds a BComm (Hons) in Applied Development Economics from the University of the Witwatersrand and an Erasmus Mundus Joint Masters in Economic Policies for the Global Transition. He has worked with SCIS, UNCTAD and co-founded Rethinking Economics for Africa.